Key Court Rulings Enhanced Prohibition Enforcement

Scroll to read more

Key Court Rulings Enhanced Prohibition Enforcement

The U.S. Supreme Court handed down two decisions as a result of Prohibition that would make legal history. Both cases in the late 1920s centered on the prosecution of liquor law violators who claimed the government violated their constitutional rights. One case would be used to bring down America’s premiere bootlegger, Al Capone, and the other produced an influential opinion challenging the use of wiretaps and contending that citizens have a “right to be left alone.”

The first case, United States vs. Sullivan, reached the high court in 1927. The defendant, Manly “Manny” Sullivan, appealed his 1922 conviction for evading federal taxes on income from running illegal whiskey, in violation of the National Prohibition Act. Sullivan, who claimed the liquor transported by boat to Charleston, South Carolina, was not his, appealed his conviction claiming that filing a tax return on gains from criminal activity violated his right against self-incrimination under the Fifth Amendment. A federal court of appeals sided with Sullivan, stating that while his ill-gotten income was subject to federal taxes, the Fifth Amendment protected him because in filing a return he would be admitting he committed a crime. Mabel Willebrandt, the assistant U.S. attorney general assigned to enforce federal tax and Prohibition laws, asked the Supreme Court to review the case on appeal.

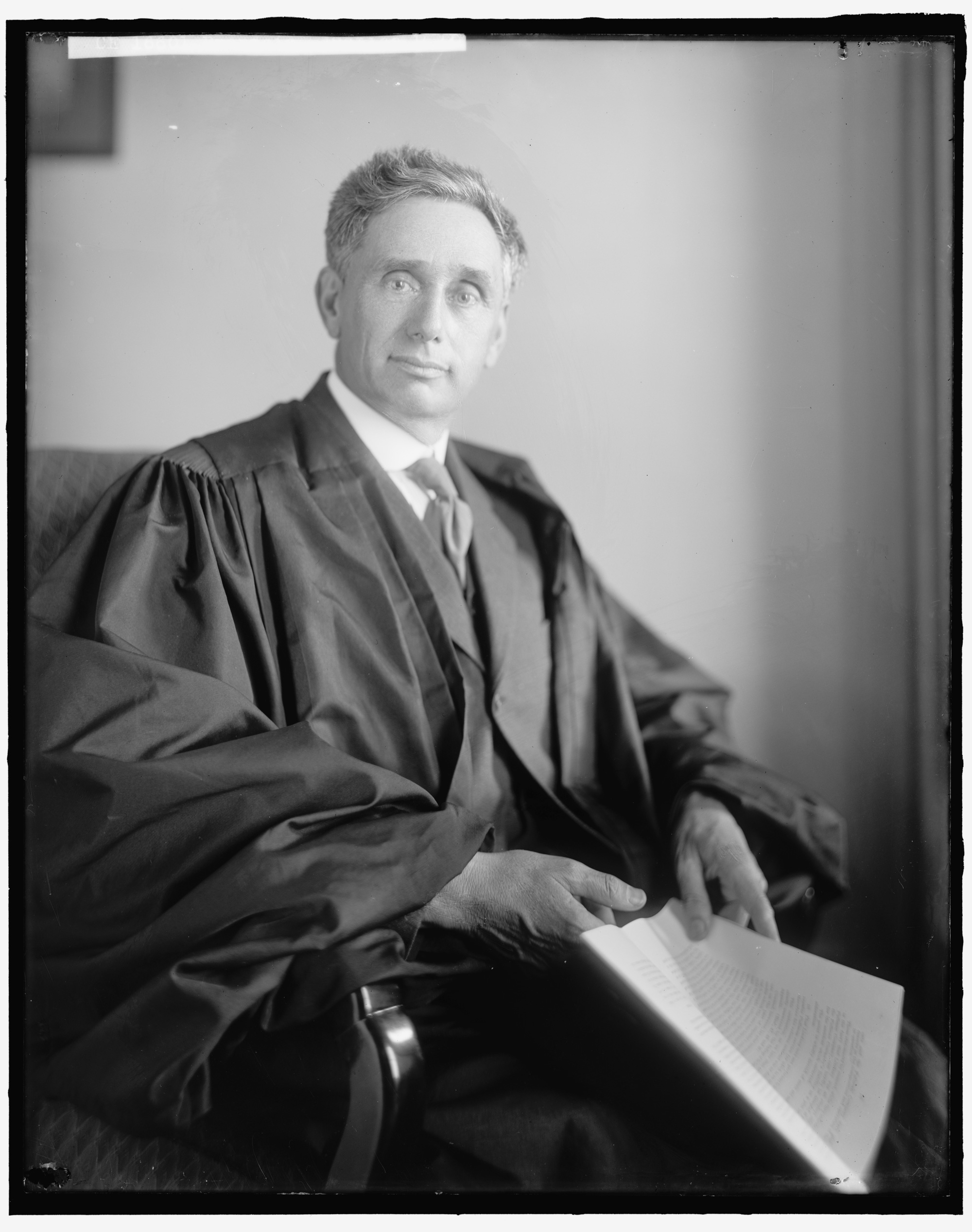

Willebrandt herself stood before the Supreme Court to argue the government’s case against Sullivan. She insisted that Sullivan’s income from the criminal sales of liquor was taxable by the IRS, that Sullivan violated tax laws by not reporting that income and that the Fifth Amendment was no defense. On May 16, the court overruled the appeals court, deciding that gains from the illicit liquor business are subject to the income tax and that the Fifth Amendment did not protect someone who willfully refused to file a return.

“It would be an extreme if not an extravagant application of the Fifth Amendment to say that it authorized a man to refuse to state the amount of his income because it had been made in crime,” Justice Oliver Wendell Holmes Jr. wrote for the majority.

The Supreme Court ruling emboldened the IRS in its investigation of Al Capone, the nation’s top racketeer. Now they had a high court decision to help them target Capone — who had save for some minor crimes been able to avoid prosecution. IRS officials pored over Capone’s own ledgers and other sources to estimate his income at more than $1 million from 1924 to 1929. In failing to file any federal tax returns, they claimed he evaded about $219,000 in federal taxes. With penalties adding up to $164,000, Capone owed the IRS $383,000. In 1931, a jury convicted Capone of tax evasion and a judge sentenced him to 11 years in federal prison, fined him $50,000 and ordered him to pay $215,000 in back taxes. Capone remained in prison until 1939.

The second case, Olmstead vs. U.S., reached the Supreme Court a year later in 1928. Seattle bootlegger Roy Olmstead filed an appeal of his 1926 conviction for conspiracy to violate the National Prohibition Act. Prosecutors alleged that Olmstead, a former Seattle police lieutenant, led a gang that used boats and trucks to smuggle liquor from Canada and supply as many as 200 cases per day within Seattle. His operation made an estimated $2 million a year. Olmstead contended that federal Prohibition agents gathered evidence of the alleged conspiracy in part through wiretaps on his gang’s phone conversations. The agents intercepted conversations of people using Olmstead’s phone service to order illegal liquor for delivery. Two allegedly corrupt Seattle police officers were also charged.

During the trial in 1926, prosecutors did not enter as evidence the transcripts of the wiretapped phone conversations but used them to help Prohibition agents refresh their memories while testifying. The agents and members of Olmstead’s gang used as government witnesses detailed how the rumrunning ring sold liquor. Defense attorneys said that evidence obtained by government wiretapping violated their clients’ Fourth Amendment rights against unreasonable searches and seizures and the transcripts of conversations used in court violated their Fifth Amendment protections against self-incrimination. Still, Olmstead and 20 defendants were found guilty in 1926.

After losing at the U.S. Circuit Court of Appeals, Olmstead and the other defendants took their case to the Supreme Court. Again they maintained that the evidence and testimony used against them should be suppressed because Prohibition agents used wiretaps, which were illegal under Washington state law, and should not be admissible in court.

This time, Willebrandt, who opposed the use of wiretapping, stepped aside and had another federal attorney make the oral argument for the government. A divided high court decided 5-4 against, therefore upholding the convictions of Olmstead and his co-defendants.

Writing for the majority, Justice William Howard Taft compared wiretaps to legitimate undercover investigations by law enforcement. Since agents placed the wiretaps in the street outside of Olmstead’s home and did not enter his home or office to perform the wiretaps, they did not trespass to search a constitutionally protected area, and so obtained the evidence legally, Taft said.

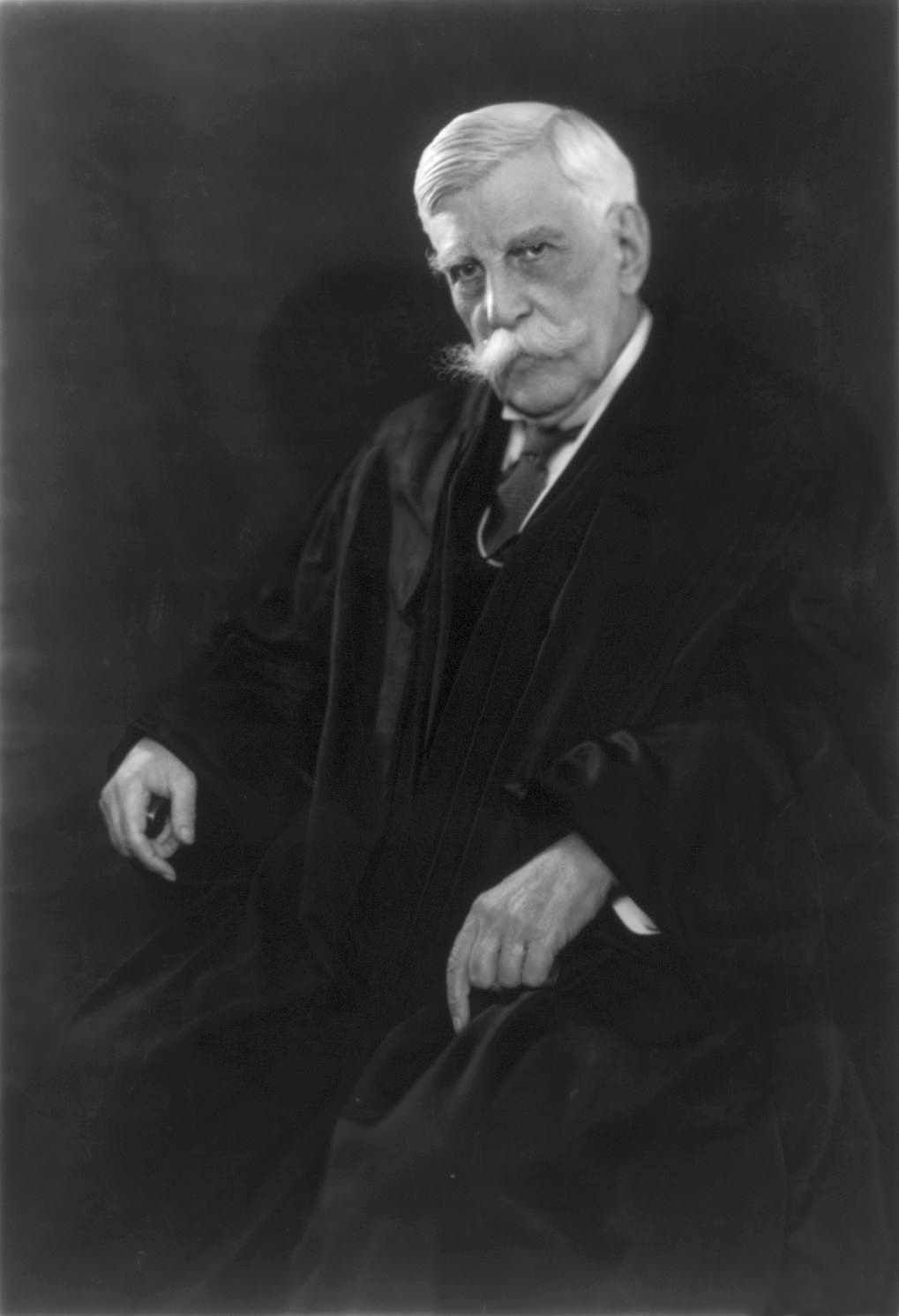

Those against the ruling included Justices William Brandeis, Pierce Butler, Harlan Fiske Stone and Holmes. Brandeis’ written dissent in Olmstead vs. U.S. famously advocated that the Constitution guaranteed a right to privacy, or “a right to be let alone,” from government intervention. Brandeis asserted that the intent of the Fourth Amendment was to prohibit infringement of an individual’s privacy and liberty and that wiretaps amounted to illegal seizures of phone conversations. “There is, in essence, no difference between a sealed letter and the private phone message,” he wrote. The justice also concluded that the Olmstead case defendants were denied their Fifth Amendment rights.

Even though Olmstead and his cohorts lost, the case changed federal law. It brought the issue of wiretapping conversations to the fore. After the repeal of Prohibition, public opinion turned against wiretapping. Taft himself in his opinion mentioned that Congress could outlaw it if it wanted to. Congress did just that with the Communications Act of 1934, which made wiretapping a criminal offense and evidence obtained from it inadmissible in federal court.

Olmstead vs. U.S. remained the Supreme Court’s dominant case law on wiretapping until 1967, when the court in Katz vs. U.S. ruled that eavesdropping on a suspect’s phone conversation by law enforcement, even without physical trespass, still violated the person’s Fourth Amendment right to a “legitimate expectation of privacy in the invaded space,” that is, unless the law officer first obtained a warrant to do it.

Willebrandt, in her book The Inside of Prohibition, addressed her disapproval of wiretapping but acknowledged that it “disclosed an illegal liquor business of amazing magnitude” in the Olmstead case.

“Although personally I would still use my influence to prevent the policy of wiretapping being adopted as a Prohibition enforcement measure, I nevertheless recognize that the interpretation of the United States Constitution against the lawbreaker and in favor of the government’s right to catch him is a Prohibition victory of no small proportions,” she wrote.